Contents

The reality is different and consists of using a Forex auto trader that assists in the trading process rather than as a standalone trading robot. A forex trading bot is an automated trading program that uses rules and algorithms to trade stocks, commodities, or currencies on foreign exchange markets. It allows you to set up auto-trading strategies without having to manually check the markets, place buy and sell orders, keep track of positions and so on.

How to ensure your broker is on the right side of the CFTC and the NFA? Stay on the lookout for claims that you can “trade” forex without actually purchasing currency. Because unless you purchase the underlying asset – whether it’s a currency pair or a commodity – you’re either trading CFDs or engaging in spread betting. If you still believe forex automated trading is better, appreciate that it’s not a get-rich-quick scheme. It’s a unique industry subset that takes years to master, even for the most experienced. As we’ve already mentioned, verified results are crucial for forex software trading.

For example, are you looking for a 100% automated process, or are you looking to retain some control of your portfolio? You also need to consider the legitimacy of the platform, fees, and which assets you will be gaining exposure to. You must open an account with your broker through us or use an existing one so we can pay the AutoTrade providers commissions for successful trades generated in your account. Despite the vast ocean of available robots, it is an unscrupulous industry with very little regulation. It is common to encounter scams where developers use false advertising with overinflated performance figures or sell poorly coded bots.

- The top forex robots suggest solutions for traders to identify profitable trades even in unstable markets, even when the actual trading direction is unclear.

- Your first port of call is to assess whattypeof auto trading platform you will be joining.

- Your Expert Advisors will be able to trade any financial asset class .

- Although this can happen with manual trading, some traders believe robots should have near-100% win rates.

- The links contained in this review may result in a small commission if you opt to BUY the product recommended and there will be no additional cost to you.

Many financial firms resemble a tech company more than a financial services firm, and FinTech drives innovation. Trading with one of the best automated Forex brokers adds to the long-term profitability, and we have identified some excellent choices. This means that it should be able to generate consistent profits over time.

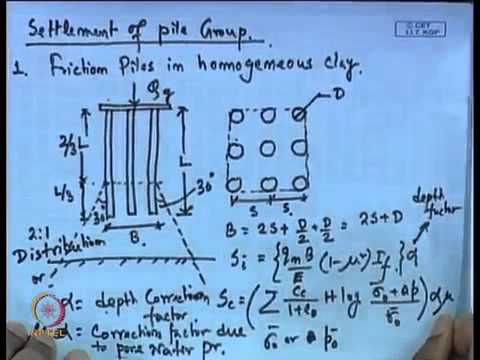

Human intervention is then about choosing and tweaking trading algorithms based on performance. Automated trading systems typically require the use of software linked to a direct access broker, and any specific rules must be written in that platform’s proprietary language. The TradeStation platform, for example, uses the EasyLanguage programming language. The figure below shows an example of an automated strategy that triggered three trades during a trading session. CTrader Automate API gives you access to all the data you will need to develop a robot or indicator, including market data and trading functions.

FAQ and More on Automated Trading Forex Brokers

It is the opposite of manual or discretionary trading, where the investor is responsible for executing positions themselves. On most platforms, after you select an investor, you simply set the system to ‘follow’ or ‘copy, and your account automatically mirrors the positions of the master trader. InstaForex is a CFD broker providing access to forex, stocks, cryptocurrencies, commodities, energies, indices, and more. With competitive fees and a huge range of available assets, the brand offers safe and reliable trading. Pionex is a cryptocurrency exchange with impressive automated trading tools and bots. Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement.

We have picked OANDA as the best automated trading forex broker with MT4. We have picked IC Markets as the best overall automated trading forex broker. There are no special techniques used in automated forex tradings; it is only the orders executed at a faster speed using technical analysis without human intervention. Automated trading accounts for 80%+ of daily equity market turnover, while the Forex market sees a lower number. There is no precise data, but leading algorithmic Forex brokers report more than 60% of their trade transactions as automated. Forex robots use technical analyses to identify trading opportunities.

Software follows a set of rules and criteria, programmed by the developer and/or tailored by the individual forex trader. Automated trading systems minimize emotions throughout the trading process. By keeping emotions in check, traders typically have an easier time sticking to the plan. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade.

Automated Forex Trading

The platform boasts access to thousands of third-party technical indicators to assist in developing trading apps, advanced charts, chart drawing tools and social trading services. A forex robot is computer software or program designed with a set of forex trading signals https://1investing.in/ that helps to define whether to buy or sell a certain currency pair at a particular time. Trading robots are available to forex traders and can be easily purchased over the internet. However, it is imperative to know that there is no holy grail of forex trading systems.

This is important as you don’t want to waste time trying to figure out how it works. Lastly, the robot must come with a money back guarantee so that you can test it out without any risk. Usually these systems only work under certain market conditions, depending of the trading strategy of its programming. Scams are an unfortunate reality in the automated forex software market, but they may be avoided by conducting due diligence on any firm. Check the websites of both the Commodity Futures Trading Commission and the National Futures Association for consumer alerts.

Best Overall Automated Trading Platform Broker

Automated trading helps ensure discipline is maintained because the trading plan will be followed exactly. For instance, if an order to buy 100 shares will not be incorrectly entered as an order to sell 1,000 shares. Automated trading with social-copy or algorithmic trading tools can be profitable, yet CFDs are complex instruments that come with a high risk of losing money, regardless of your trading strategy.

The failure of lots of Forex robot investor customers is that they just trade their automatic Forex trading system with genuine funds without doing any type of screening or optimization. The reality is, Difference between Ex Works and FCA by way of Delivery is not as very easy as individuals that marketed you your Foreign exchange robot investor claim it is. The settings of your Foreign exchange robot investor need to be tailored an appropriate danger level, and also constantly updated to keep it in tune with the dominating market conditions.

After learning the MQL4, it is simple to create and develop your own Expert Advisors . C language is the 5th most popular language on GitHub, so access to developers with an ability to code in or learn MQL4 should be high. The Price action course is the in-depth advanced training on assessing, making and managing high probability price action trades. Being educated in the Foreign Exchange market is the most important asset of your portfolio. We alsoreached out to customer supportto solve issues that we had encountered.

Forex Automatic Trading

In the case of robots and forex EAs, all you need to do is install the software onto MT4 and then run the platform on demo mode. Instead, they are merely supplying trading suggestions and/or software. With this in mind, the automated trading platform does not answer to a regulator or financial body of any sort. If using an automated trading platform via MT4, then you will need to purchase a robot or forex EA from a third-party provider. There are many things that you need to think about before choosing the best automated trading platform for your needs. Crucially, not only will you be risking your own money – but you are handing the decision-making investment process over to a third-party.

After all, the signal provider will be scanning the markets on your behalf and telling you what trades to place. With this in mind, we suggest making the following considerations in your search for the best automated trading software reviews of 2022. Although the strategies are provided by third-party vendors – there is a simple, risk-free way to test them out. Use the NinjaTrading demo account facility and see how the automated platform performs. Users can view reports in real-time, allowing you to amend, be interactive and tweak the algorythm until it meets the desired strategy.

Learn About Automated Forex Trading..

The top forex robots suggest solutions for traders to identify profitable trades even in unstable markets, even when the actual trading direction is unclear. They are designed to follow the best trends that would boost profits and eliminate the chances of potential losses. This minimum cost for this forex trading software account is 50 dollars. It was developed in 2001 and it is used in many countries by traders for help in their trade. It has many uses and it is the best automated software that gives both mobile and desktop functionalities. The automated trading software can be created and it can also be bought.

However, keep in mind that most robots trade within a certain range. They are designed to make a particular amount of pips insight a specified range during the slowest time on the market. They usually set a few pip targets and don’t always use the stop-loss signs. The forex robots are regarded as successful if they make profits in every trade, even if it is only a few pips.

OANDA also offers an attractive rebate program to American clients to reward high-volume traders. These services offer real-time data on how a bot is performing with no tampering from the trader. Also, you should understand critical metrics like drawdown and profit factor to have a deeper knowledge of the system.

Once you have chosen a reputable forex robot, you will need to set it up and configure it. This can be a complex process, so it is worth taking the time to do it properly. Even though the Forex market is a very volatile market, there are automated Forex trading algorithms that make it possible to trade it successfully. Customer product reviews that are posted online are a good source of information about the software. Trading approaches will vary in risk, with programs geared to scalping a few points in a trade to taking larger bets.

While these events are rare, it is one example where a manual trader has the flexibility to change their approach and stay away from danger. Yet, a robot doesn’t have the same ability since it only follows instructions without questioning them. Nadex offer genuine exchange trading to global clients on Binary Options. Although our platform application needs to be constantly running on your laptop/PC, if you want it to operate while you are away, there is no need to leave your laptop/PC turned on all day long. The word “automation” may seem like it makes the task simpler, but there are definitely a few things you will need to keep in mind before you start using these systems.

Leave a reply